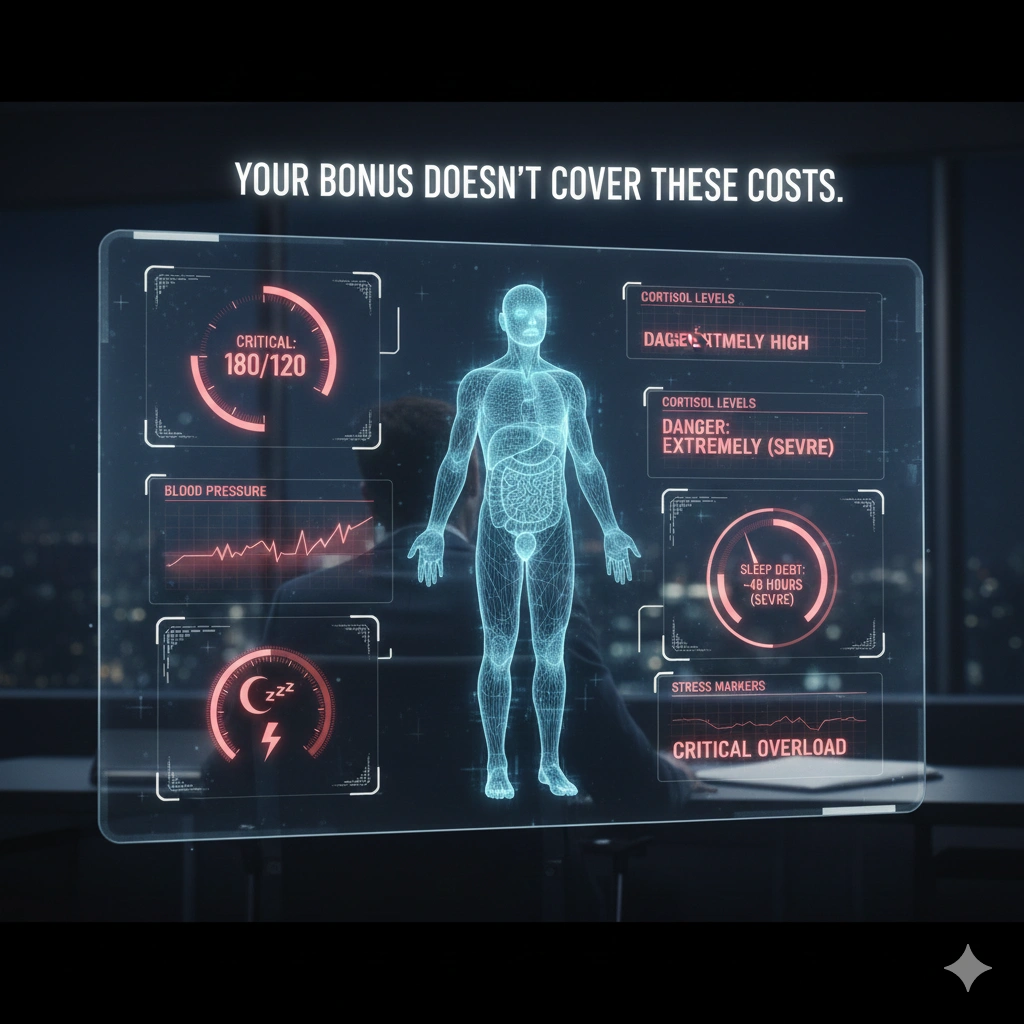

100-hour weeks and the cruel myth of work-life balance—welcome to high finance, where your six-figure salary can’t compensate for the life you’re losing one all-nighter at a time.

It’s 3:47 AM. You’re on your fourth Red Bull, staring at Excel models that stopped making sense two hours ago. The pitch deck is due at 7 AM for a client meeting you’re not even attending. Your vision blurs. Your hands shake. Somewhere in the recesses of your exhausted mind, you remember you had a life before this—friends, hobbies, a partner who still texts even though you haven’t responded in three days.

This is investment banking. This is management consulting. And the bonus check you just deposited? It doesn’t buy back the years you’re losing.

The Gilded Cage: When Compensation Becomes Compensation

McKinsey’s 2022 global survey of nearly 15,000 employees revealed a stark truth: one in four employees across demographics worldwide reported experiencing burnout symptoms. But in investment banking and elite consulting? Those numbers skyrocket. Research shows that 72% of bankers are considering quitting to avoid burnout, with 51% aware their colleagues are already planning exits.

The industry sells you a dream: work brutally hard for a few years, collect massive bonuses, exit to somewhere prestigious, live happily ever after. But here’s what nobody mentions in those recruitment presentations: the psychological carnage you’ll accumulate along the way. The relationships you’ll destroy. The health conditions you’ll develop. The person you used to be who slowly disappears beneath the spreadsheets.

A 2025 investigation documented that junior investment bankers routinely work 100-hour weeks, with some reporting working until 5 AM multiple days consecutively. Goldman Sachs analysts created a leaked survey revealing that 77% experienced workplace abuse, with chronic sleep deprivation becoming normalized rather than addressed.

1. The Time Bankruptcy: When 168 Hours Isn’t Enough

“I Calculated My Hourly Rate After Taxes. I Make Less Than My Housekeeper.”

Let’s do the math together. You’re making $150,000 as a first-year analyst. Sounds impressive until you divide by actual hours worked. At 100 hours weekly, that’s roughly $29 per hour before taxes. Your college friends working standard 40-hour weeks at $80,000? They’re making $38.50 per hour with weekends free.

But the real theft isn’t financial—it’s temporal. Investment bankers spend up to 40 hours weekly on manual, repetitive tasks that could be automated. That’s an entire additional job’s worth of time wasted on formatting PowerPoints and reconciling spreadsheets while clients and strategic thinking starve for attention.

The consequences compound. Research indicates that chronic lack of sleep and high workload create a cycle of stress and fatigue, making burnout inevitable rather than possible. Your cognitive sharpness deteriorates. Decision-making suffers. Ironically, the very hours you’re logging make you less effective at the work you’re doing.

McKinsey consultants report similar patterns. One former consultant described his Friday routine: arriving home at 6 PM so exhausted he’d fall asleep on the couch, wake at 8 PM for a shower and dinner, too depleted to socialize even when partners wanted to go out. Monday through Thursday started at 8 AM with partners and engagement managers queuing up for discussions, creating an unsustainable cycle where recovery became impossible.

Research Study

McKinsey’s 2023 burnout research found that burnout is driven by chronic imbalance between job demands and available resources. Employees experiencing high workplace demands were eight times more likely to report burnout symptoms, with those symptoms predicting six times higher intent to leave within three to six months.

Study link

Addressing employee burnout: Are you solving the right problem?

Mindful Solutions

The 3-Minute “Deal Desk Breath” Practice When you’re in the middle of crushing hours and can’t escape:

Minute 1: Physical reset

- Push away from your desk

- Stand up, stretch arms overhead

- Roll shoulders backward 5 times

- Shake out hands and wrists

Minute 2: Breath regulation

- Inhale slowly for 4 counts through your nose

- Hold for 4 counts

- Exhale for 6 counts through your mouth

- Repeat 4 times

Minute 3: Reality anchor

- Name 3 things you can control right now (your breath, your posture, your next task)

- Name 1 thing you’re choosing (even if it’s “I’m choosing to finish this model before leaving”)

- Set a specific end time for your current task

This practice, adapted from stress management techniques, helps prevent the dissociative state that comes from endless work hours.

Time Boundary Protocol

- Identify your “hard stop” time 3 days weekly (e.g., leave by 8 PM on Tuesdays, Thursdays, Sundays)

- Communicate this clearly to your team in advance

- Use mindful leadership principles to frame this as sustainable performance, not laziness

- Track whether violating this boundary actually resulted in better work outcomes (spoiler: it rarely does)

2. The Performance Treadmill: When Excellence Becomes Exhaustion

“I Haven’t Missed a Decimal in Three Years. I Also Haven’t Smiled in Three Years.”

The perfectionism demanded in high finance isn’t just about getting things right—it’s about getting things flawless under impossible conditions while pretending you’re thriving. This creates what researchers call “cognitive overload”: the mental strain of continuous problem-solving combined with decision fatigue and the perfectionist pressure that mistakes could cost millions.

Investment banks operate on razor-thin error margins. A misplaced decimal point in a pitch book can derail a multimillion-dollar deal. Management consultants face similar pressures—presenting to Fortune 500 CEOs means every slide, every insight, every recommendation must be bulletproof. The stress isn’t just from working hard; it’s from working perfectly while chronically sleep-deprived.

McKinsey research reveals that employees experiencing toxic workplace behavior were eight times more likely to experience burnout symptoms. In banking and consulting, “toxic behavior” often manifests as unrealistic perfectionism: being berated for minor errors, having work torn apart and redone multiple times, absorbing senior bankers’ stress and anxiety as they’re passed down the hierarchy.

The performance anxiety never stops. Investment banking’s competitive culture means constant comparison with peers. You’re not just trying to do good work—you’re trying to outperform every other analyst who also went to a top school and also works inhuman hours. This relentless pursuit of excellence becomes emotionally and mentally draining, with success feeling temporary and failure feeling catastrophic.

Research Study

A comprehensive 2024 analysis on investment banking burnout found that intense competition and performance expectations, combined with high-pressure environments and strict deadlines, create chronic stress leading to serious health issues including cardiovascular disease, diabetes, and autoimmune disorders.

Mindful Solutions

The 2-Minute “Pitch Anchor” Practice Before high-stakes presentations or critical deliverables:

Seconds 1-30: Ground in the present

- Press feet firmly into floor

- Feel the chair supporting you

- Notice the weight of your body

Seconds 31-60: Name your competence

- Silently list 3 specific skills you have (e.g., “I know this model,” “I’ve done this analysis,” “I understand these metrics”)

- Acknowledge: “I prepared. I know this material.”

Seconds 61-90: Release the outcome

- Recognize what you can’t control (client reactions, partner moods, deal success)

- Affirm: “I will do my best work. The outcome isn’t entirely mine to control.”

Seconds 91-120: Set intention

- Choose one word for how you want to show up (confident, clear, calm)

- Take one deep breath embodying that word

This mindfulness anchor practice helps separate your self-worth from performance outcomes—critical for sustained mental health in high-pressure environments.

The “Good Enough” Exercise

Weekly, identify one task where 85% perfection achieves the same outcome as 100%:

- Is this internal deck or client-facing?

- Does this specific formatting matter?

- Will anyone notice this level of detail?

Learning to calibrate effort based on actual impact prevents the exhaustion of perpetual perfectionism. This requires breaking recurring perfectionist patterns that fuel burnout.

3. The Identity Trap: When Your Title Becomes Your Personality

“Someone Asked What I Do For Fun. I Couldn’t Remember.”

Here’s the insidious part: investment banking and management consulting don’t just take your time—they colonize your identity. You stop being a person who works in finance and become “a banker.” You stop being someone who consults and become “a McKinsey person.” Your personality, interests, and sense of self all compress into a single professional identity.

This identity hijack happens gradually. First, you’re working too hard to maintain hobbies. Then, your friends outside finance can’t relate to your schedule or stress. Eventually, your entire social circle consists of colleagues who also work 100-hour weeks, creating an echo chamber where the insanity seems normal.

The former McKinsey consultant mentioned earlier described suffering from emotional burnout—no longer believing in what he was doing, questioning whether there must be more to life than this. This type of burnout is harder to recover from than physical exhaustion because you’re questioning your life choices, decisions, and reason for being.

Research confirms this pattern: when employees lack autonomy and impact at work, they develop mental distancing and emotional impairment. You become cynical about the work itself. The deals start feeling meaningless. The presentations feel performative. You’re going through motions but your authentic self has checked out.

The social isolation compounds the problem. Long hours squeeze out family time, friendships, and personal hobbies, leading to feelings of loneliness and disconnection. You miss weddings, birthdays, your own life milestones because there’s always another deal, another pitch, another deadline.

Research Study

McKinsey’s Holistic Health research across 30,000 employees in 30 countries found that more than a third of respondents in 29 surveyed countries reported exhaustion, with burnout strongly predicted by workplace demands while holistic health was predicted by workplace enablers—demonstrating that compensation and titles can’t substitute for actual wellbeing.

Study link

Reframing employee health: Moving beyond burnout to holistic health

Mindful Solutions

The Identity Diversification Protocol

Intentionally maintain three non-work identities:

- A skill/hobby (music, cooking, art, sport—something you’re building competence in that’s unrelated to finance)

- A relationship role (sibling, partner, friend—where you show up for others beyond professional capacity)

- A learning pursuit (language, history, philosophy—intellectual engagement unrelated to work)

Schedule weekly time for each, even if just 30 minutes. This creates identity resilience so that job loss or career change doesn’t obliterate your sense of self.

The Weekly Self-Audit

Every Sunday, answer these questions:

- What did I do this week that had nothing to do with work?

- Who did I connect with outside my professional network?

- What thought or idea did I engage with that wasn’t work-related?

- If I quit tomorrow, what parts of me would survive?

This weekly reflection practice maintains perspective on who you are beyond your job title.

4. The Health Mortgage: When Your Body Keeps Score

“My Doctor Said My Stress Levels Resemble Combat Veterans. I Just Analyze Spreadsheets.”

Your body doesn’t distinguish between life-threatening danger and pitch book deadlines. The cortisol release is the same. The fight-or-flight activation is identical. And when that system runs constantly for years? The damage is measurable and severe.

Chronic stress from investment banking leads to serious health issues: cardiovascular disease, diabetes, autoimmune disorders, depression, anxiety disorders, and substance abuse as a coping mechanism. Wall Street’s “dangerous grind” has been linked to elevated rates of anxiety disorders, with documented cases of young bankers dying from stress-related complications.

The 2021 Goldman Sachs analyst survey documented the physical toll: analysts working until 5 AM, dealing with chronic sleep deprivation, experiencing significant mental health problems. Research confirms that recurring all-nighters and weeks without time off are ruinous to employee health, leading to chronic fatigue, burnout risk cycles, and decreased cognitive sharpness.

Management consultants report similar physical deterioration. The heavy hours, limited vacations, poor diet (endless fast food with meal allowances), rare exercise, and inefficient work habits eventually take their toll. One consultant described how his Friday exhaustion couldn’t be fixed by weekend rest—the debt had accumulated beyond recovery.

The mental health statistics are equally alarming: a Wall Street analysis found that investment bankers experience depression and small mental breakdowns commonly, with colleagues acknowledging that everyone in the industry faces some level of depression.

Research Study

Following the tragic death of Bank of America associate Leo Lukenas in 2024, investigations revealed that the systematic culture of 100+ hour weeks creates health consequences comparable to occupational hazards, with OSHA-recognized links between workplace stress and serious cardiovascular issues and mental illness.

Mindful Solutions

The Non-Negotiable Health Trinity

Even during deal season, protect these three things:

- 6-Hour Sleep Minimum (not 4-hour naps—actual consolidated sleep)

- Use sleep tracking to hold yourself accountable

- Communicate to seniors: “I’ll deliver better work with 6 hours sleep than 3”

- Sleep science proves exhausted work is worse work

- One Real Meal Daily (not at desk, not while working)

- 20 minutes minimum to eat without screens

- Choose nutrition over convenience at least once daily

- Your cognitive function depends on actual fuel, not just caffeine

- 15-Minute Movement (walking, stretching, anything non-sedentary)

- Set phone reminders every 3 hours

- Walk while taking calls when possible

- Use dopamine reset strategies to break sedentary patterns

Emergency Physical Reset (60 seconds)

When your body is screaming but you can’t stop:

- Stand up immediately

- Do 10 jumping jacks OR run in place for 20 seconds

- Splash cold water on face and wrists

- Drink a full glass of water

- Take 3 deep breaths before sitting back down

This activates your parasympathetic nervous system, counteracting the constant fight-or-flight state that’s destroying your health.

5. The Exit Paralysis: When Golden Handcuffs Become Real Chains

“I’ll Leave After This Bonus. I’ve Been Saying That For Four Years.”

Perhaps the cruelest trap: you know you’re burning out. You know the work is unsustainable. You know you’re sacrificing your health, relationships, and sanity. But you can’t leave. Not yet. Not before the bonus. Not before making VP. Not before proving you can do it.

The financial compensation creates psychological dependency. You’ve adjusted your lifestyle to match your income—the apartment in an expensive city, the student loan payments, the expectations of family who don’t understand you can’t “just find another job” that pays $200,000 at age 26. The golden handcuffs aren’t just financial—they’re identity-based, status-based, sunk-cost-fallacy-based.

Research shows that 72% of bankers are considering quitting, with 51% aware colleagues are planning exits—yet many don’t actually leave. The reasons are complex: fear of wasting the “investment” of brutal years, concern about explaining departure to future employers, uncertainty about what else provides similar compensation and prestige.

Management consultants face identical paralysis. The former McKinsey consultant mentioned spending months slowly recognizing that the Friday exhaustion wasn’t just end-of-week tiredness but systemic burnout. Getting through emotional burnout is harder than physical exhaustion because you’re questioning your entire life trajectory without a map or guidebook to navigate the exit.

The irony is devastating: firms implement “support systems” like protected Saturdays, 80-hour work week caps, wellness programs—but 96% of bankers want additional support systems beyond what’s currently offered, and 43% feel only moderately satisfied with existing measures. The bandaids don’t address the systemic hemorrhaging.

Research Study

UpSlide’s 2025 Investment Banking Burnout report found that bankers want to spend 25% of time with clients, 23% on strategic tasks, 23% on creative and ideation processes—but instead spend 40 hours weekly on manual tasks that could be automated, representing $2,000+ in lost value per employee and perpetuating the burnout cycle.

Study link

Investment Banking Burnout: A Temperature Check

Mindful Solutions

The Exit Clarity Exercise

Right now, before the next bonus cycle, answer honestly:

- What’s your actual number?

- How much money in savings would allow you to leave comfortably?

- Be specific: $X in liquid assets, $Y in retirement accounts

- Work backward: at current savings rate, when do you hit this number?

- What’s your non-financial exit criteria?

- Health threshold (e.g., “if doctor warns about stress-related illness”)

- Relationship threshold (e.g., “if partner issues ultimatum”)

- Identity threshold (e.g., “if I can’t remember the last time I felt like myself”)

- What are you actually gaining by staying?

- List concrete skills, connections, experiences

- Distinguish between genuine growth and just “more of the same”

- Ask: “Am I still learning or just surviving?”

The Monthly Freedom Fund

Regardless of bonus timeline, start building your exit fund:

- Automatically save a fixed percentage each paycheck

- Keep this separate from lifestyle spending

- Calculate your “freedom date”—when you can afford to leave regardless of bonus timing

This creates actual agency over your career trajectory rather than being perpetually trapped by the next compensation cycle.

The Alternative Path Research

Spend 2 hours monthly exploring:

- What former analysts/consultants are doing now (LinkedIn stalking counts)

- Industries that value your skills without the hours (fintech, corporate strategy, startups)

- What lifestyle you actually want versus what you’ve defaulted into

Knowledge is power. Understanding your options reduces the fear that traps you in burnout.

The System Is Broken, But You’re Not

Let’s be brutally honest: the investment banking and management consulting industries are designed to extract maximum value from young talent while they’re willing to sacrifice everything. It’s not a bug—it’s the business model. You work inhumane hours during the years you’re less likely to have family obligations, extract the learning and compensation, then either burn out or climb high enough that you’re exploiting the next generation.

McKinsey’s research makes the systemic nature clear: burnout is experienced by individuals, but the most powerful drivers are systemic organizational imbalances across job demands and resources. As one analyst put it: “You can’t yoga your way out of these challenges.” Individual wellness programs won’t fix structural exploitation.

What Actually Needs to Change (Institutional Level):

- Honest Recruitment: Stop selling “work-life balance” that doesn’t exist. Tell recruits the actual hours, the health risks, the relationship toll.

- Protected Time Enforcement: Not suggested guidelines but enforced limits with consequences for violations. Track manager compliance, not just analyst hours.

- Meaningful Work Redistribution: Automate the 40 hours of manual tasks. Use saved time for strategic work, client interaction, and genuine learning.

- Destigmatize Mental Health: Make therapy and counseling genuinely confidential and accessible. Address the shame around admitting struggle.

- Redefine Success: Stop promoting only those who work the longest hours. Reward efficiency, innovation, and sustainable performance.

Will these changes happen? Not without pressure. Not without talent actually leaving. Not without junior bankers and consultants demanding better.

The Choice You Actually Have

You entered high finance for specific reasons: intellectual challenge, financial security, career prestige, or maybe you didn’t know what else to do with your degree. Whatever brought you here, you’re now facing a choice that nobody prepared you for in business school.

The question isn’t: “Can I survive these hours?” The question is: “What am I willing to sacrifice to stay in this system?”

Because make no mistake—sacrifice is mandatory. The only variable is what you’re willing to lose:

- Your health (physical and mental)

- Your relationships (romantic, familial, friendships)

- Your sense of self (who you are beyond your job)

- Your years (the twenties you’ll never get back)

The mindfulness practices outlined here—the Deal Desk Breath, the Pitch Anchor, the Identity Diversification Protocol, the Health Trinity, the Exit Clarity Exercise—these aren’t solutions to a broken system. They’re survival tools for navigating that system while you decide whether survival is enough.

Research from McKinsey demonstrates that adaptability acts as a buffer against toxic workplace factors while magnifying benefits of supportive environments. Employees who developed emotional flexibility through training experienced three times more improvement in leadership dimensions and seven times more improvement in wellbeing. But here’s the critical nuance: more adaptable employees were 60% more likely to leave toxic environments because they had the confidence to know they deserved better.

Conclusion: The Bonus Check That Couldn’t Buy Back Your Life

You’re reading this article at 2 AM, aren’t you? Or maybe during a rare lunch break. Or on your phone while you’re supposed to be relaxing this weekend. The fact that you found this article, that you’re still reading, means some part of you knows this isn’t sustainable.

The uncomfortable truth: your six-figure compensation isn’t buying the life you imagined. It’s buying a very expensive prison where the bars are made of Excel and the guards are managing directors who worked similar hours thirty years ago and believe you should too.

McKinsey’s 2023 research across 30 countries found that holistic health—physical, mental, social, and spiritual—predicts work engagement, innovation, and job performance. But achieving holistic health requires workplace enablers, not just individual resilience. Providing enablers alone won’t mitigate burnout, and addressing demands alone won’t improve holistic health. A complementary approach is needed.

The complementary approach starts with you: recognizing burnout before it progresses to crisis, protecting your health boundaries as fiercely as you protect client confidentiality, maintaining identity beyond your title, and building the financial and emotional resources to walk away when the cost exceeds the compensation.

Your bonus can’t buy back the years of health deterioration. It can’t resurrect the relationships you neglected. It can’t restore the person you were before banking consumed everything. But what it can buy is options—if you use it strategically to build an exit rather than just a more expensive lifestyle that traps you longer.

The financial industry needs reform. But while we wait for Goldman Sachs and McKinsey to prioritize human wellbeing over profit margins, you need survival strategies. Use the mindfulness practices. Build the exit fund. Diversify your identity. Protect your health.

And when someone asks what you do for fun—have an answer ready that doesn’t involve Excel.

If you’re experiencing severe burnout from investment banking or consulting

- Seek immediate support from a mental health professional specializing in high-stress occupations

- Connect with the stress and burnout resources at Mindful Engineer

- Remember: Your value as a human being isn’t measured in deals closed or models built

For ongoing support managing the unique pressures of high-performance careers, explore mindful leadership strategies and science-backed stress management.

Your career is important. Your life is irreplaceable. Know the difference.

Research Sources Cited

- McKinsey Health Institute (2022-2023) – Global burnout surveys (15,000+ employees)

- McKinsey (2023) – Holistic health research across 30 countries

- Goldman Sachs Working Conditions Survey (2021) – Analyst burnout documentation

- UpSlide Investment Banking Burnout Report (2025) – 72% exit consideration data

- Bank of America / Leo Lukenas Investigation (2024) – 100+ hour weeks health consequences

- OnLabor Wall Street Workplace Reform Analysis (2024) – Occupational hazards research

- NeuroLaunch Investment Banking Burnout Study (2024) – Health impacts analysis

- Firms Consulting Burnout Testimony (2023) – Former McKinsey consultant personal account

- AlphaSense / Inc. Magazine (2024-2025) – Junior analyst attrition and hour-capping initiatives

- Wall Street Journal Investigation (2024) – Bank of America work conditions exposé